RiverTown Home

Family and 4-plex Housing

Located within walking distance from River Falls High School, Rivertown Homes is the perfect setting to watch your family grow. Enjoy taking your kids to the playground on site or on a short walk or bike ride to the park down the street. RiverTown Homes provides one, two, three and four bedroom townhomes for families with rent starting at $50 per month.

A townhome or duplex with a full basement and private front and back doors open to your own yard. Inviting living space, substantial bedroom size and ample storage in the basement to house all of your needs.

Does this sound like the place for you? Apply today!

Rivertown Homes Information

The Details

Below you will find general information about Rivertown Homes. This includes information on rent, funding and finances, building amenities, and more. If you have any questions about either of these buildings, please contact our staff at RFHA. We are always happy to help!

Our Building

Family

- Duplex/townhome

- Built in 1971

- Off-street parking

4-Plex

- Townhome

- Build in 1990

- Off-street parking

Our Units

Family

- 33 total units

- 3 one bedroom units

- 16 two bedroom units

- 12 three bedroom units

- 2 four bedroom units

4-Plex

- 4 total units

- 2 two bedroom units

- 2 three bedroom units

Preference

- Designated for families with children

- Designated for adults with low or moderate income

- 1 person Income limit $68,500

- 2 persons Income limit $78,250

- 3 persons Income limit $88,050

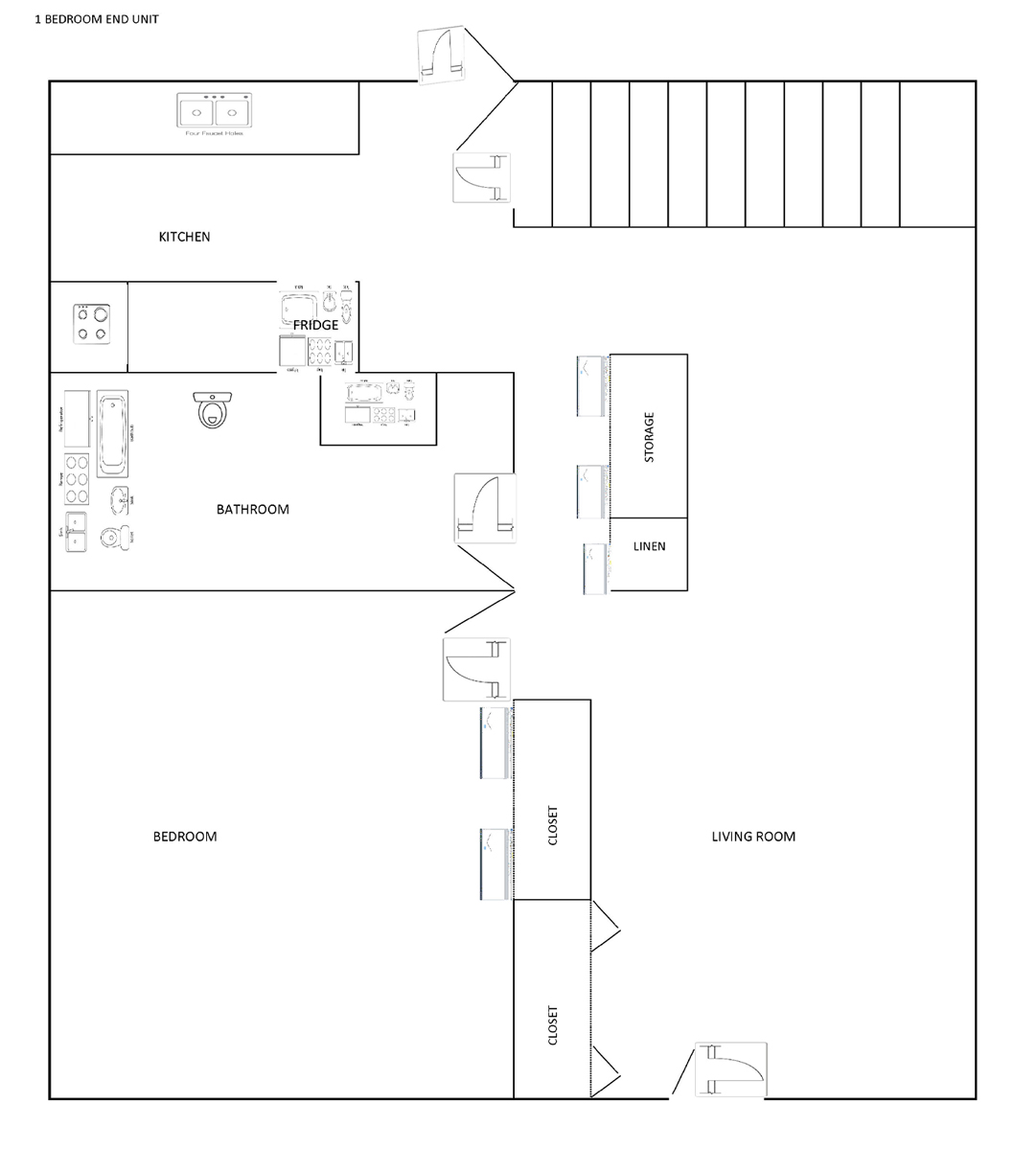

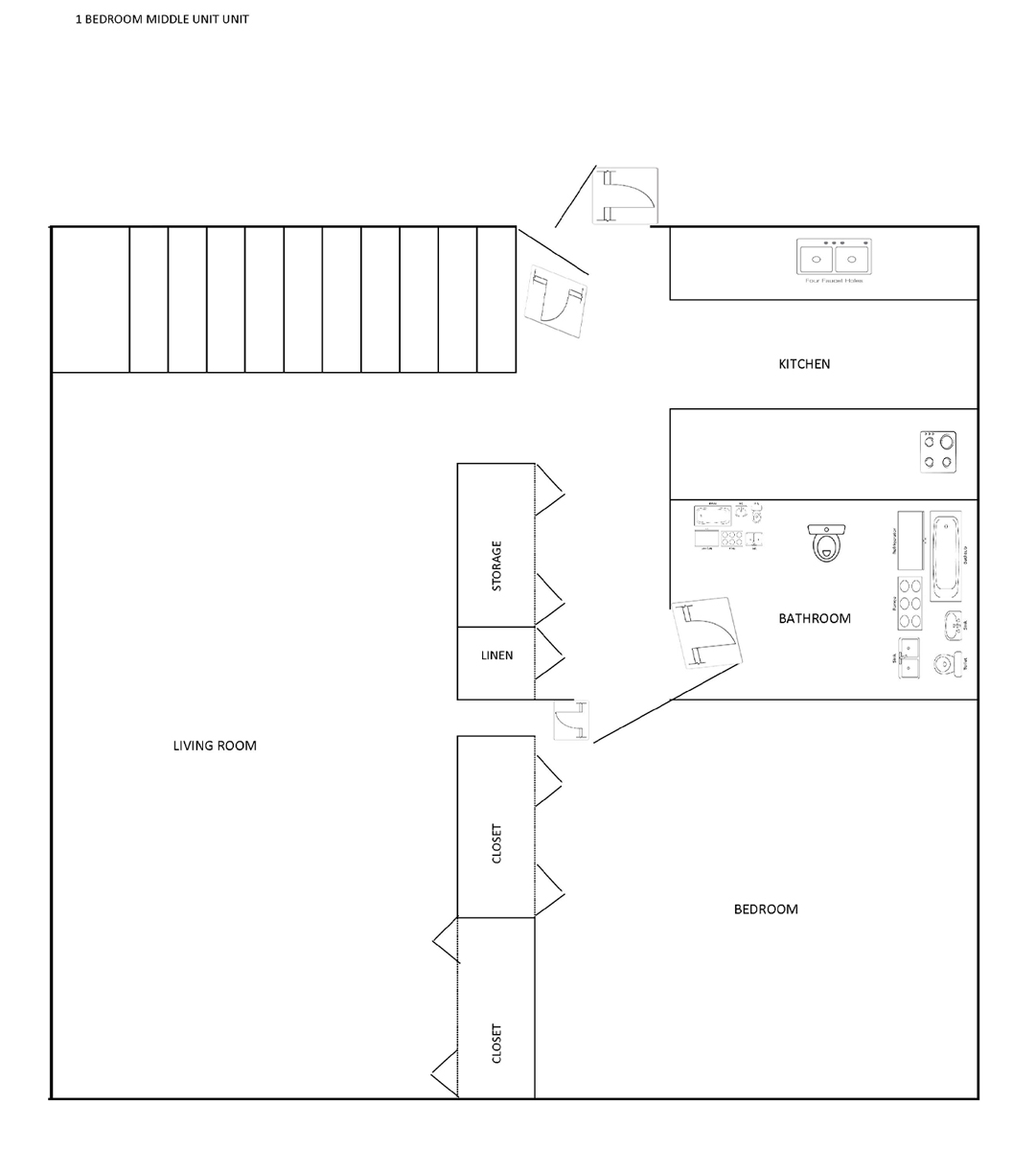

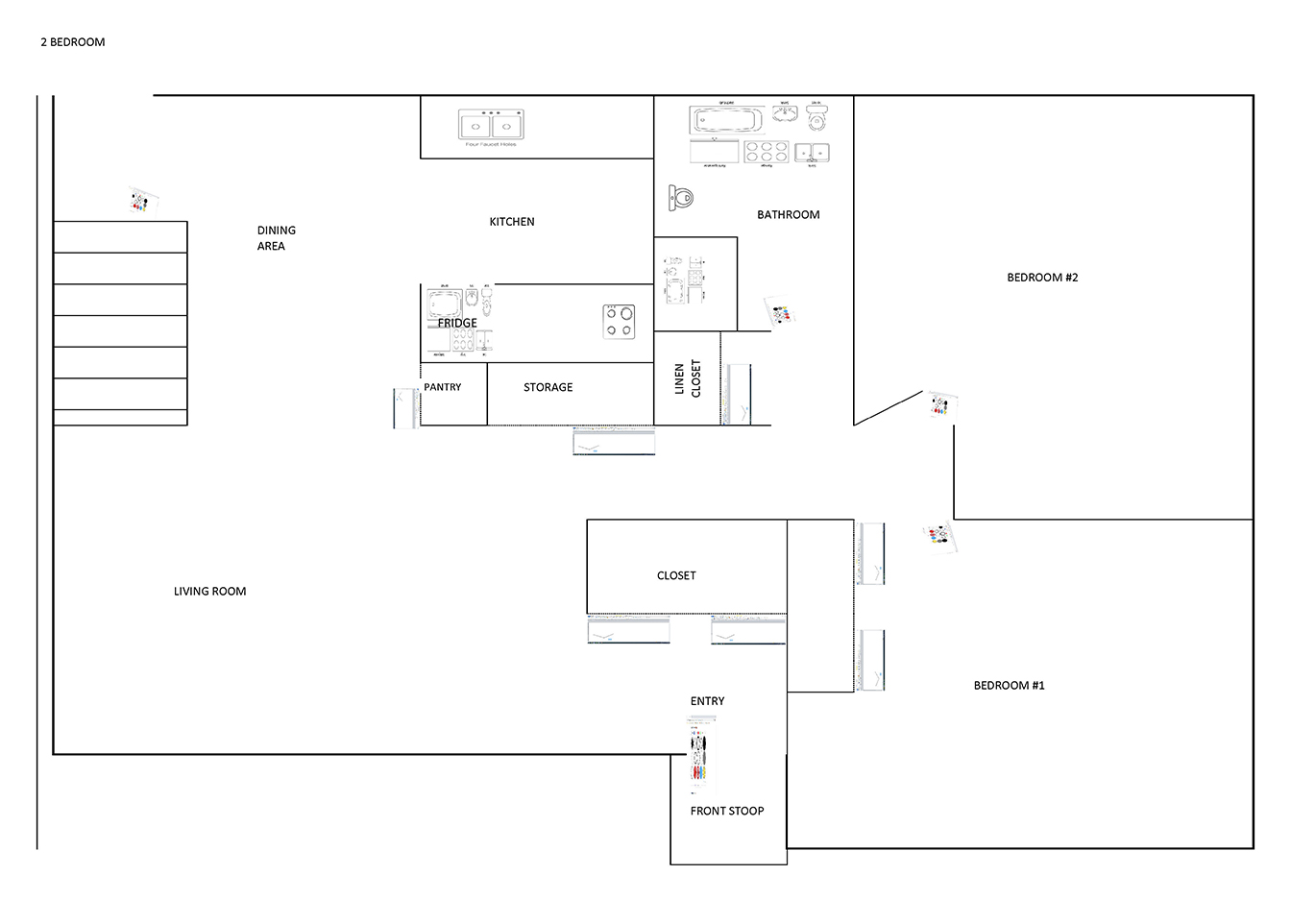

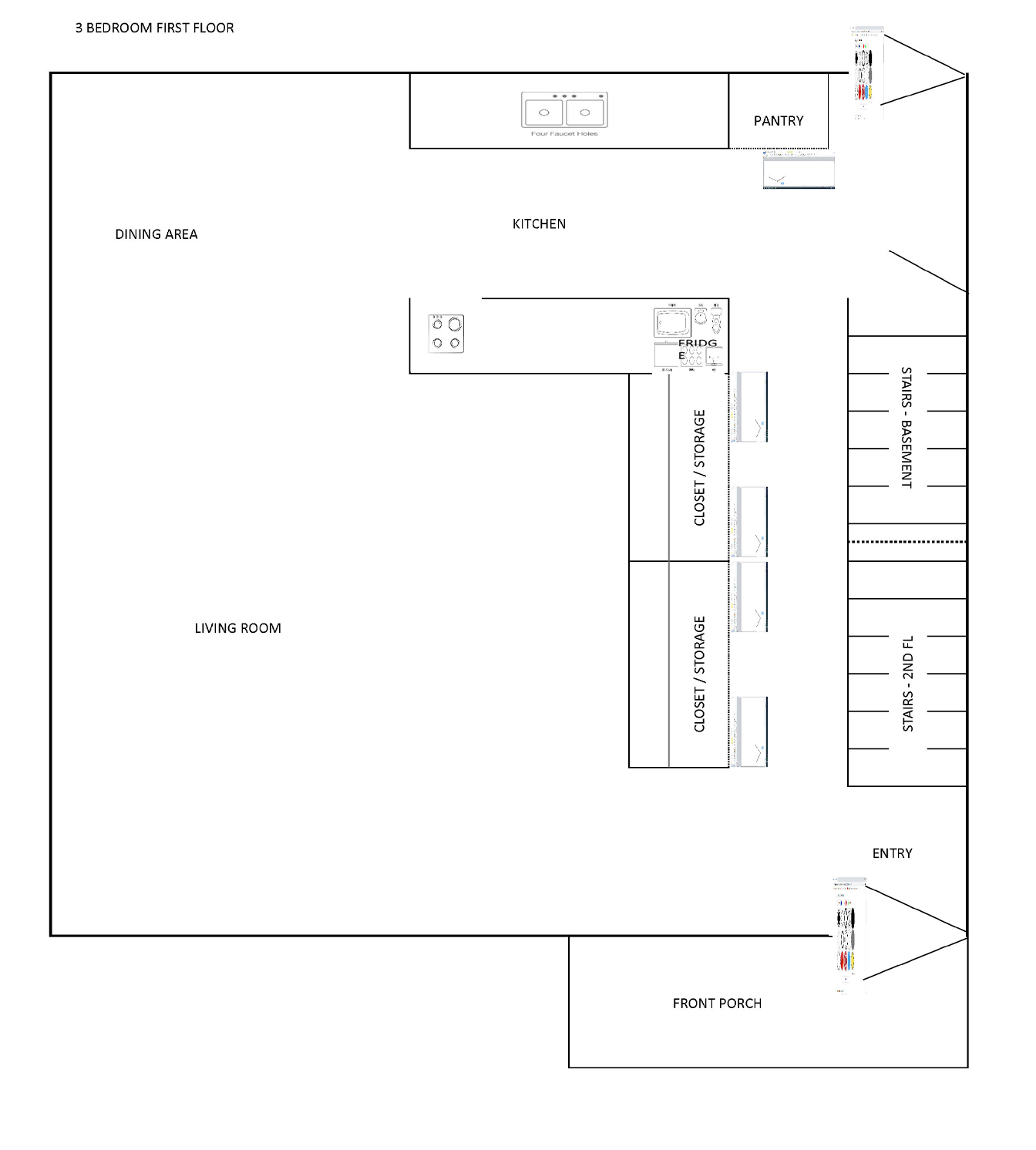

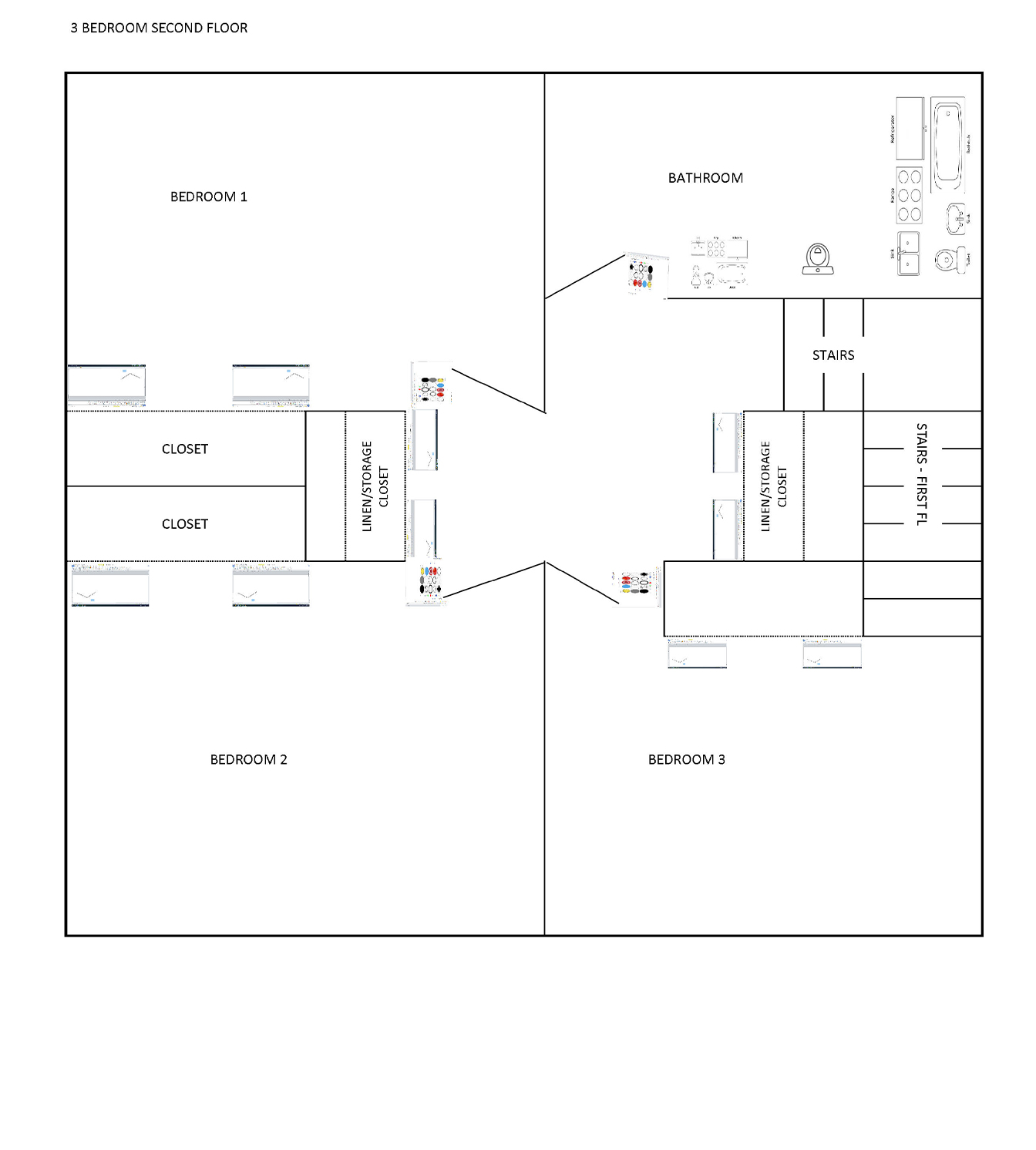

Floor Plans

1 Bedroom

2 Bedroom

3 Bedroom

Amenities

- Spacious one, two, three and four-bedroom townhomes

- Galley kitchen with stove and refrigerator

- Large basement for all your storage needs

- Hook up for cable, telephone, and internet

- Access to playground and basketball court

- Washer and dryer hook-ups in the basement

- Outdoor storage shed

- Off-street parking

- Private entrance

- Utilities included in rent

Rent Information

Tenant rent is 30% of the adjusted household income or paid at a flat rate but no less than the minimum. Three of the four 4-plex townhomes receive Rural Development Rental Assistance which subsidizes the difference between 30% of the tenant’s income and the minimum rent. Security deposit is $600. Heat, electricity, hot water and trash removal/recycling are

included in the rent.

Finances

FAMILY

There is no debt on this development. Tenant rent pays 40% of the operating costs. Congress allocates funding for all HUD programs annually. HUD recaptures excess reserves held by a Housing Authority. Operating funding is determined using a formula that considers the cost of the utilities included in the rent, cost of the audit, the age of the building and the vacancy rate. Funds must be used for routine property management. The Board of Commissioners approves the operating budget each year in April. Operating funding from HUD usually does not meet all of the operating costs and has not been awarded on a regular schedule. Capital funding is intended for non-routine maintenance and capital improvements. Annually, funds are awarded based on age of the property, type of structure and number of units. The Board of Commissioners approve the five year capital improvements plan and prioritize spending once Capital funds are awarded by HUD.

FEDERAL PROGRAMS:

HUD Public Housing

FUNDING:

Public Housing Operating Fund

Capital Fund

4-PLEX

Minimum and maximum rents are budget based. The minimum rent is the monthly per unit cost of routine operating costs. The minimum rent includes paying a mortgage on this property at 1% interest rate. As explained in the audit report, this building has an interest credit to reduce the cost of operating. The maximum rent includes a mortgage payment at the note rate as started when the mortgage originally loaned to the Housing Authority. None of the units are handicapped accessible. All units have the bathroom on the second floor and a full basement.

The Board of Commissioners and USDA Rural Development approve the operating budget and rent change annually. Routine operating expenses include replacement of appliances and carpets as needed. Budget planning takes into account anticipated unit turnover and costs to prepare units for re-rental.

A Reserve for Replacement account is a separate account for capital improvements. Monthly deposits are made to the project reserves. Rural Development approval is needed for any expenditure from the Reserve account.

FEDERAL PROGRAMS:

USDA Rural Development Section 515

FUNDING:

Multifamily Direct Loan Section 515

USDA Section 521Rental Assistance